Mobile Trading Showdown: TradingView App vs Thinkorswim Mobile Experience

In today's fast-paced trading environment, mobile accessibility has become essential for traders who need to monitor markets and execute trades on the go. This comprehensive analysis compares two leading mobile trading platforms—TradingView and Thinkorswim—examining their chart functionality, order execution capabilities, alert systems, and overall user experience to help you determine which platform best suits your mobile trading needs.

Platform Overview and Mobile Philosophy

TradingView and Thinkorswim approach mobile trading from distinctly different perspectives. TradingView's mobile app emphasizes chart analysis and social trading features, maintaining the platform's core strength in technical analysis while adapting it for smaller screens. The interface prioritizes visual clarity and intuitive navigation, making it accessible for traders of all experience levels.

Thinkorswim Mobile, developed by TD Ameritrade, takes a more comprehensive approach by attempting to replicate much of the desktop platform's functionality on mobile devices. This results in a feature-rich application that appeals to active traders who require advanced tools and direct market access while away from their primary trading stations.

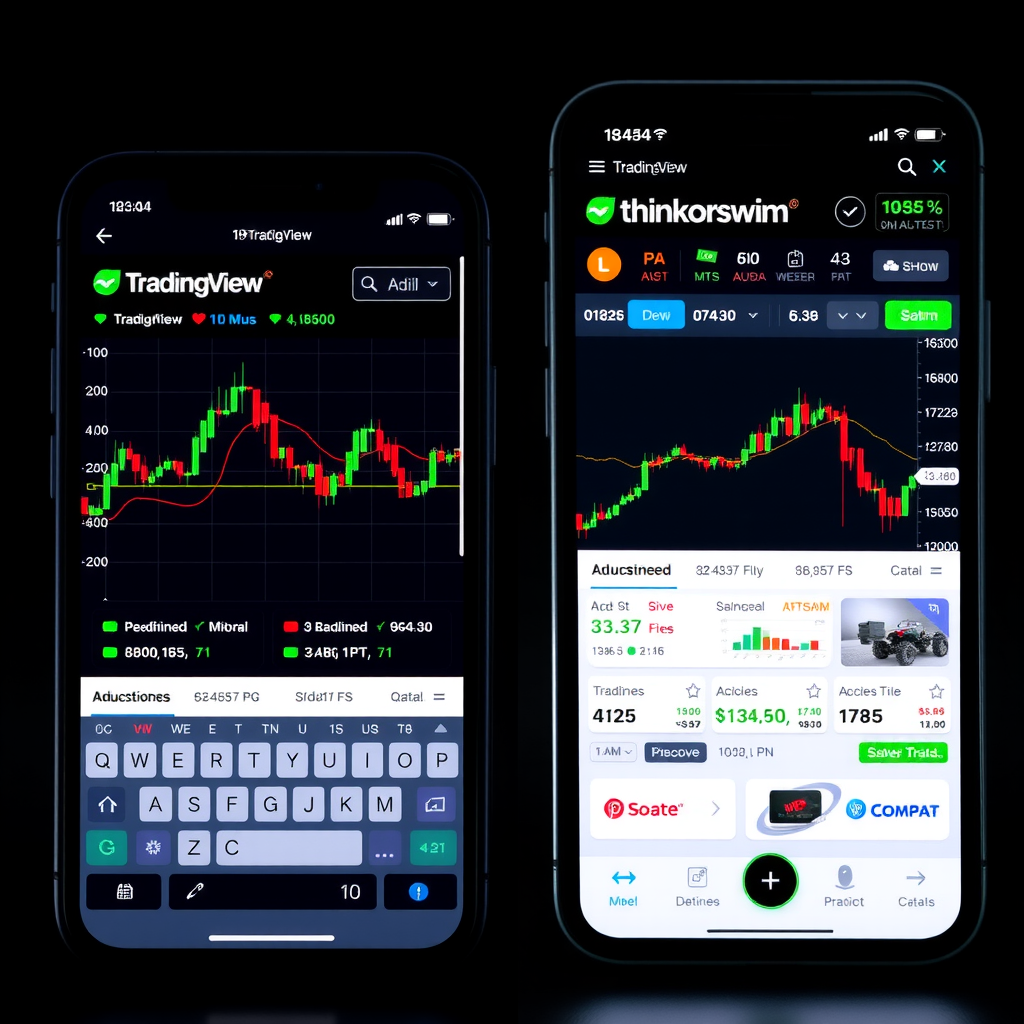

Chart Functionality and Technical Analysis

TradingView Mobile Charting

TradingView's mobile charting experience stands out for its exceptional visual quality and smooth performance. The app supports over 100 technical indicators, multiple chart types including candlestick, bar, line, and Heikin Ashi, and provides access to the platform's extensive drawing tools library. Users can create multi-timeframe layouts, though the mobile interface naturally limits the number of simultaneous charts compared to desktop.

Strength:TradingView's mobile charts maintain the same high-quality rendering and smooth zooming/panning capabilities as the desktop version, with minimal lag even when multiple indicators are applied.

Thinkorswim Mobile Charting

Thinkorswim Mobile offers robust charting capabilities with access to over 400 technical studies and a comprehensive suite of drawing tools. The platform excels in providing advanced features like custom study creation, complex multi-leg options strategies visualization, and real-time Level II data integration directly on charts. However, the interface can feel more cluttered on smaller screens due to the density of available features.

The mobile app supports flexible chart layouts and allows traders to save multiple workspace configurations. Chart studies can be customized extensively, matching the desktop experience in terms of parameter adjustments and visual styling options.

Order Execution and Trading Capabilities

Order execution represents a critical differentiator between these platforms, as TradingView and Thinkorswim serve fundamentally different roles in the trading ecosystem.

TradingView Trading Panel

TradingView's mobile app provides integrated trading through broker connections, supporting over 15 major brokers including Interactive Brokers, TradeStation, and various cryptocurrency exchanges. The trading panel offers a streamlined interface for placing market, limit, and stop orders directly from charts.

However, the platform's primary focus remains on analysis rather than execution, which means advanced order types and complex trading strategies may require switching to your broker's native platform.

Thinkorswim Order Entry

Thinkorswim Mobile excels in order execution capabilities, offering comprehensive access to all order types including OCO (One-Cancels-Other), bracket orders, and complex multi-leg options strategies. The platform provides real-time position monitoring, profit/loss tracking, and instant order modification capabilities.

Direct market access and integration with TD Ameritrade's infrastructure ensures reliable execution with minimal latency, making it suitable for active day traders who need to manage positions on the go.

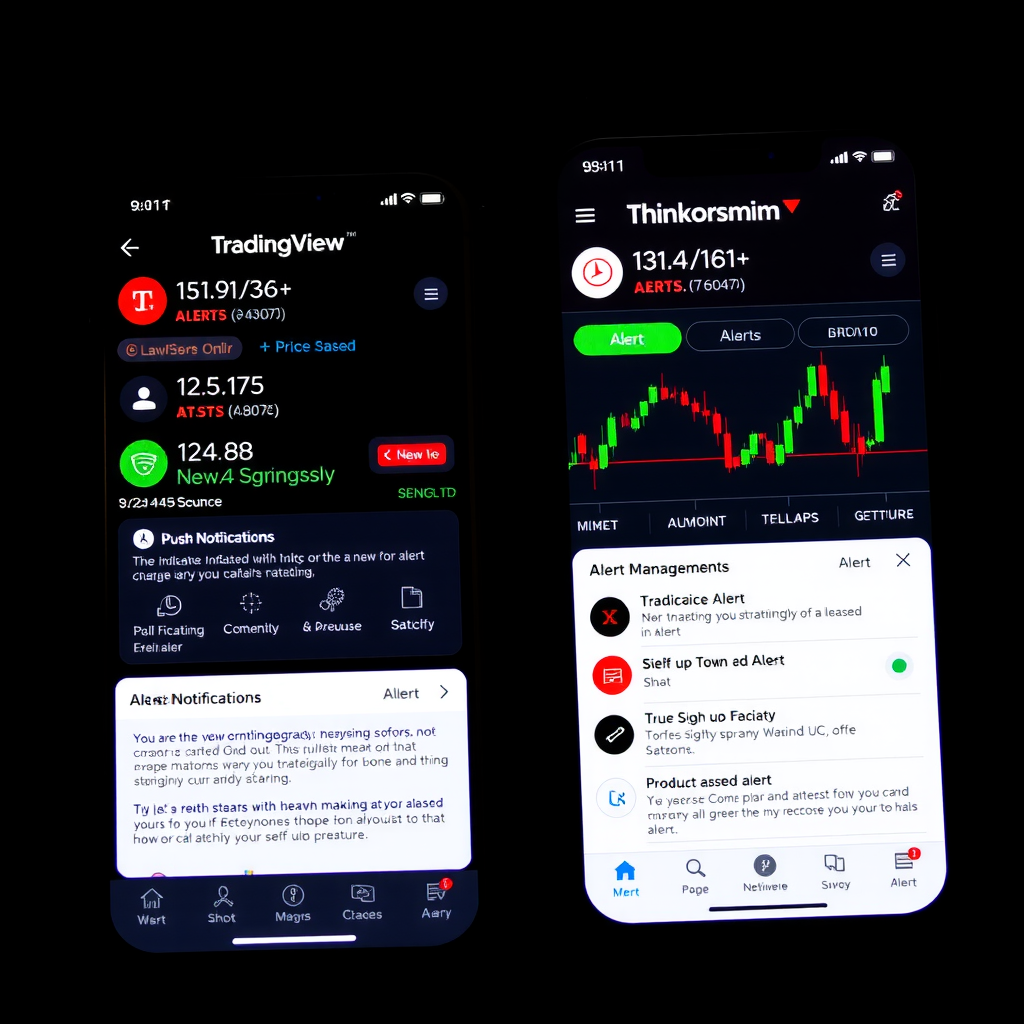

Alert Systems and Notifications

Both platforms recognize the importance of timely notifications for mobile traders, but they implement alert systems with different levels of sophistication and customization.

TradingView Alert Capabilities

TradingView's alert system is highly regarded for its flexibility and ease of use. Traders can create alerts based on price levels, indicator conditions, drawing tool interactions, and custom script conditions using Pine Script. The mobile app allows users to create, modify, and manage alerts directly from charts, with push notifications delivered instantly to mobile devices.

Alert limits vary by subscription tier, with free users receiving limited alerts while Pro+ subscribers enjoy unlimited alert creation. The notification system is reliable and includes options for sound alerts, pop-up notifications, and email delivery.

Thinkorswim Alert Framework

Thinkorswim provides a comprehensive alert system integrated with its thinkScript programming language, enabling traders to create highly sophisticated conditional alerts. The mobile app supports price alerts, technical indicator alerts, and custom study-based notifications. Users can set alerts for specific account events, such as order fills, margin calls, or position changes.

The platform's alert management interface allows for detailed customization of notification preferences, including the ability to specify different alert methods for various market conditions or trading scenarios.

User Interface and Navigation Experience

The mobile user experience differs significantly between these platforms, reflecting their distinct design philosophies and target audiences.

TradingView Mobile Interface

TradingView's mobile interface prioritizes simplicity and visual appeal. The app features a clean, modern design with intuitive gesture controls for chart manipulation. Navigation follows familiar mobile patterns with a bottom tab bar providing quick access to watchlists, charts, alerts, and social features.

The chart interface maximizes screen real estate by hiding toolbars until needed, with tools and indicators accessible through clearly labeled menus. The learning curve is minimal, making it accessible for traders transitioning from other mobile apps or new to technical analysis.

User Experience:TradingView's mobile app consistently receives high ratings for its intuitive design and smooth performance, with users praising the seamless synchronization between mobile and desktop platforms.

Thinkorswim Mobile Navigation

Thinkorswim Mobile presents a more complex interface that reflects the platform's comprehensive feature set. The app uses a tab-based navigation system with sections for charts, watchlists, account information, and news. While this provides extensive functionality, it can feel overwhelming for new users or those accustomed to simpler mobile trading apps.

The interface density increases on larger mobile devices and tablets, where the app can display more information simultaneously. Experienced traders appreciate the depth of available tools, though the learning curve is steeper compared to TradingView's more streamlined approach.

Consideration:The complexity of Thinkorswim Mobile may require a significant time investment to master, but rewards users with powerful capabilities once learned.

Performance and Reliability

Mobile trading demands reliable performance and stable connectivity, especially during volatile market conditions when timely execution is critical.

TradingView Performance

- Lightweight app with minimal battery drain

- Smooth chart rendering even with multiple indicators

- Fast synchronization across devices

- Reliable real-time data streaming

- Occasional delays during extreme market volatility

- Works well on older mobile devices

Thinkorswim Reliability

- More resource-intensive application

- Excellent order execution reliability

- Stable performance during market hours

- Direct broker integration ensures data accuracy

- May experience slowdowns on older devices

- Higher battery consumption during active use

Data Access and Market Coverage

The breadth and quality of market data available on mobile devices significantly impacts the trading experience and analytical capabilities.

TradingView Market Data

TradingView provides extensive market coverage across global exchanges, including stocks, forex, cryptocurrencies, futures, and indices. The mobile app offers real-time data for many markets, though some exchanges require additional subscriptions. The platform excels in cryptocurrency coverage, providing data from numerous exchanges with minimal delay.

Free users receive delayed data for most stock markets, while paid subscribers gain access to real-time quotes. The mobile app seamlessly integrates with TradingView's data infrastructure, ensuring consistent information across all devices.

Thinkorswim Data Integration

Thinkorswim Mobile benefits from TD Ameritrade's comprehensive data feeds, providing real-time quotes for stocks, options, futures, and forex at no additional cost to account holders. The platform includes Level II market depth data, time and sales information, and extensive options chain data directly on mobile devices.

The mobile app provides access to fundamental data, earnings reports, analyst ratings, and news feeds integrated with chart displays. This comprehensive data access makes Thinkorswim particularly valuable for traders who require detailed market information while mobile.

Social and Community Features

TradingView's mobile app maintains the platform's strong social trading component, allowing users to follow other traders, share chart ideas, and participate in community discussions directly from their mobile devices. The app includes a dedicated social feed where users can discover trading ideas, view published charts, and engage with the trading community through comments and reactions.

Users can publish their own chart analyses directly from the mobile app, complete with annotations and commentary. The social features integrate seamlessly with the charting tools, making it easy to share insights or learn from experienced traders while on the go.

Thinkorswim Mobile takes a more traditional approach, focusing primarily on individual trading capabilities rather than social features. While the platform includes access to TD Ameritrade's educational resources and market commentary, it lacks the community-driven aspect that defines TradingView's experience. This difference reflects the platforms' distinct philosophies—TradingView as a social trading network versus Thinkorswim as a professional trading tool.

Customization and Personalization

Both platforms offer extensive customization options, though they differ in implementation and scope on mobile devices.

TradingView Customization

The mobile app allows users to customize chart appearance, including color schemes, background styles, and candlestick colors. Indicator settings can be adjusted with the same level of detail as the desktop version, and custom templates can be saved and applied across devices.

Watchlists sync automatically across all platforms, and users can organize symbols into multiple lists with custom sorting and filtering options. The app remembers user preferences and maintains consistency with desktop settings.

Thinkorswim Personalization

Thinkorswim Mobile provides deep customization capabilities, including the ability to create and save multiple workspace layouts. Users can customize chart studies extensively, create custom scans, and set up personalized watchlists with custom columns displaying specific metrics.

The platform supports custom thinkScript indicators that sync from the desktop version, allowing traders to maintain their analytical tools across devices. Account settings and preferences synchronize automatically, ensuring a consistent experience.

Educational Resources and Support

Access to educational content and support resources on mobile devices helps traders improve their skills and resolve issues quickly.

TradingView's mobile app includes access to the platform's extensive educational content library, featuring tutorials, trading guides, and video courses. The community-driven nature of the platform means users can learn from published ideas and analyses shared by experienced traders. The app's help center provides comprehensive documentation accessible directly from mobile devices.

Thinkorswim Mobile integrates TD Ameritrade's educational resources, including articles, videos, and webinar recordings. The platform provides access to market commentary and analysis from TD Ameritrade's research team. Customer support is available through the app, with options for phone, chat, and email assistance. The comprehensive help system includes detailed guides for using mobile-specific features.

Security and Account Protection

Mobile trading security is paramount, as smartphones can be lost or stolen, potentially exposing trading accounts to unauthorized access.

TradingView implements standard security measures including encrypted connections, secure authentication, and the option to enable two-factor authentication. The app supports biometric authentication on compatible devices, allowing users to access their accounts using fingerprint or face recognition. Session management features enable users to remotely log out of all devices if needed.

Thinkorswim Mobile employs robust security protocols including encrypted data transmission, secure login procedures, and mandatory two-factor authentication for account access. The app supports biometric authentication and includes additional security features like automatic logout after periods of inactivity. As a broker-integrated platform, Thinkorswim benefits from TD Ameritrade's comprehensive security infrastructure and regulatory compliance measures.

Security Recommendation:Regardless of platform choice, always enable two-factor authentication, use biometric login when available, and avoid accessing trading accounts on public Wi-Fi networks without VPN protection.

Cost Considerations and Value Proposition

Understanding the cost structure and value provided by each platform helps traders make informed decisions based on their budget and requirements.

TradingView Pricing

The mobile app is free to download and use with basic features. Paid subscriptions unlock additional capabilities including more indicators per chart, unlimited alerts, and real-time data for various markets. Subscription tiers range from approximately $15 to $60 per month, with annual plans offering discounts.

The platform's value proposition centers on its powerful charting capabilities, social trading features, and multi-broker connectivity, making it suitable for traders who prioritize analysis over execution.

Thinkorswim Access

The mobile app is completely free for TD Ameritrade account holders, with no subscription fees or platform charges. All features, including real-time data, advanced charting, and order execution capabilities, are included at no additional cost.

The value proposition focuses on comprehensive trading capabilities, professional-grade tools, and seamless integration with TD Ameritrade's brokerage services, making it ideal for active traders who need full-featured mobile trading.

Use Case Scenarios and Recommendations

The optimal choice between TradingView and Thinkorswim mobile depends on your specific trading style, requirements, and priorities.

Choose TradingView Mobile If You:

- Prioritize chart analysis and technical indicators over order execution

- Trade across multiple brokers or exchanges

- Value social trading features and community insights

- Need cryptocurrency market coverage alongside traditional assets

- Prefer a clean, intuitive mobile interface

- Want seamless synchronization across multiple devices

- Are comfortable using your broker's platform for actual trade execution

Choose Thinkorswim Mobile If You:

- Need comprehensive order execution capabilities on mobile

- Trade actively and require professional-grade tools

- Focus on options trading with complex strategies

- Want integrated access to Level II data and market depth

- Are a TD Ameritrade account holder

- Require advanced technical analysis with custom indicators

- Value comprehensive market data and research integration

Final Verdict and Conclusion

Both TradingView and Thinkorswim offer excellent mobile trading experiences, but they serve different purposes and trader profiles. TradingView excels as a mobile charting and analysis platform with superior visual design, social features, and multi-broker connectivity. Its intuitive interface and powerful technical analysis tools make it ideal for traders who prioritize chart analysis and want flexibility in broker choice.

Thinkorswim Mobile stands out as a comprehensive trading platform that brings professional-grade capabilities to mobile devices. Its strength lies in order execution, advanced trading features, and integrated market data. For active traders who need to manage positions and execute complex strategies while mobile, Thinkorswim provides unmatched functionality.

Many traders find value in using both platforms complementarily—TradingView for chart analysis and idea generation, and Thinkorswim for order execution and position management. This hybrid approach leverages the strengths of each platform while mitigating their respective limitations.

Ultimately, the best choice depends on your trading style, technical requirements, and whether you prioritize analysis capabilities or execution features in your mobile trading experience. Both platforms continue to evolve and improve their mobile offerings, ensuring that traders have access to powerful tools regardless of their location or device.

Pro Tip:Take advantage of free trials and demo accounts to test both platforms extensively before committing. Your personal experience with the mobile interface and feature set will be the best indicator of which platform suits your trading needs.

Published on

Last updated: